Tax Policies & Governance

Chunghwa Telecom (CHT) attaches importance to tax liability and commits itself to being an honest taxpayer. Quality tax compliance is our core value. The tax policy has enacted with Chunghwa Telecom. We implement the arm's length principle. Related party transactions are conducted in line with the pertaining regulations of transfer pricing. Also, use of tax haven or tax planning for the purpose of tax evasion are avoided for a better management of the tax operation of CHT and the subsidiaries thereof. In addition, CHT supports the government in promoting major operational activities like innovative R&D activities and smart technology.

Chunghwa Telecom Group implements robust tax governance and has established an internal tax management mechanism. We engage professional consultants to provide timely information on changes in tax laws and regulations, aligning with international trends. This ensures compliance with international tax standards and maintains accuracy in tax adherence. Under the leadership of the Chairperson and CEO of Chunghwa Telecom, major decisions concerning compliance with tax laws and regulations by Chunghwa Telecom are made pursuant to the resolutions of the Board of Directors. Supervised by the Board of Directors and with the efforts of all employees, Chunghwa Telecom has achieved satisfactory operational results every year.

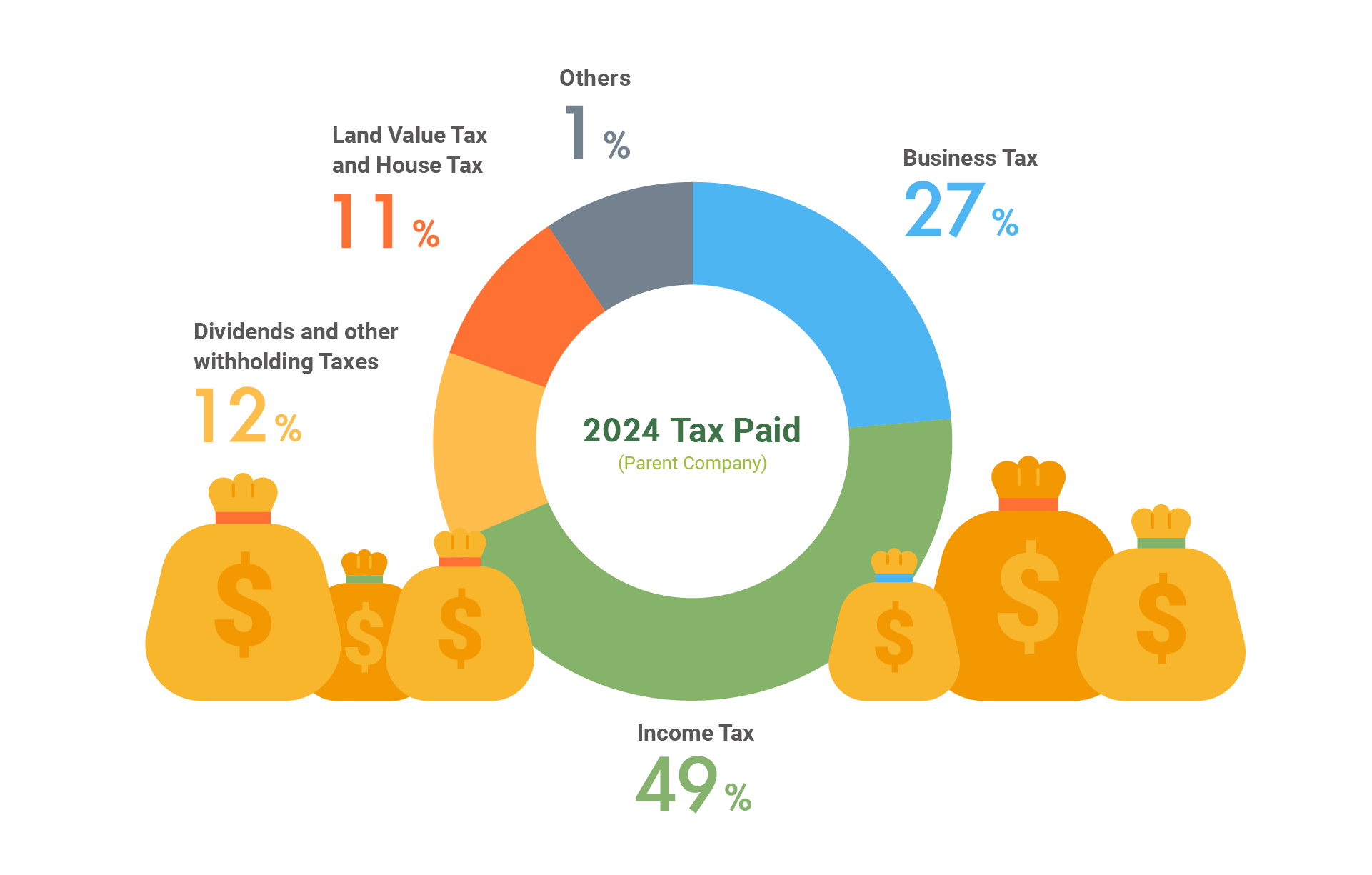

The operating results in 2024 include the taxes paid by the Headquarters of Chunghwa Telecom to the Government of Republic of China amounts to NT$17,453 million and the variety of taxes paid by Chunghwa Telecom have contributed much to the support to the government’s finance and the elevation of the people’s well-being, including the income taxes, business tax, taxes arising from dividends and other withholding taxes, property tax, and others.

- Income Tax: include mainly Profit-seeking Enterprise Income Tax and foreign tax credit

- Property Tax: encompasses the land value tax and house tax

- Others: involve stamp tax and environmental taxes. The environmental tax are taxes and expenses incurred from environmental impacts, including fuel tax and waste disposal fee, levied for the government to use on earmarked purpose of environment improvement for a better environmental protection.

Constituent Entities and Main Business Activities of Chunghwa Telecom across Tax Jurisdictions in 2024

| Tax Jurisdiction | Constituent Entities Resident in the Tax Jurisdiction | Main Business Activity(ies) | ||||||||||||

| Research and Development | Holding or Managing intellectual property | Purchasing or Procurement | Manufacturing or Production | Sales, Marketing or Distribution | Administrative, Management or Support Services | Provision of Services to Unrelated Parties | Internal Group Finance | Regulated Financial Services | Insurance | Holding Shares or Other Equity Instruments | Dormant | Other | ||

| TW | Chunghwa Telecom Co., Ltd. | |||||||||||||

| TW | Chief Telecom Inc. | |||||||||||||

| TW | Chunghwa Leading Photonics Tech Co., Ltd. | |||||||||||||

| TW | Chunghwa System Integration Co., Ltd. | |||||||||||||

| TW | Light Era Development Co., Ltd. | |||||||||||||

| TW | Spring House Entertainment Tech. Inc. | |||||||||||||

| TW | Chunghwa Investment Co., Ltd. | |||||||||||||

| TW | Honghwa International Co., Ltd. | |||||||||||||

| TW | Smartfun Digital Co., Ltd. | |||||||||||||

| TW | CHYP Multimedia Marketing & Communications Co., Ltd. | |||||||||||||

| TW | Senao International Co., Ltd. | |||||||||||||

| TW | Chunghwa Sochamp Technology Inc. | |||||||||||||

| TW | CHT Security Co., Ltd. | |||||||||||||

| TW | Unigate Telecom Inc. | |||||||||||||

| TW | Chunghwa Precision Test Tech. Co., Ltd. | |||||||||||||

| TW | Aval Technologies Co., Ltd. | |||||||||||||

| TW | Wiin Technologies Co., Ltd. | |||||||||||||

| TW | Youth Co., Ltd. | |||||||||||||

| TW | SENYOUNG Insurance Agent Co., Ltd. | |||||||||||||

| TW | ISPOT Co., Ltd. | |||||||||||||

| TW | International Integrated Systems, Inc. | |||||||||||||

| TW | Unitronics Technology Corp. | |||||||||||||

| TW | TestPro Investment Co., Ltd. | |||||||||||||

| TW | NavCore Tech. Co., Ltd. | |||||||||||||

| TW | Chunghwa Digital Cultural and Creative Capital Co., Ltd | |||||||||||||

| DE | Chunghwa Telecom Europe GmbH | |||||||||||||

| HK | Donghwa Telecom Co., Ltd. | |||||||||||||

| HK | Chunghwa Hsingta Co., Ltd. | |||||||||||||

| CN | Shanghai Chief Telecom Co., Ltd. | |||||||||||||

| CN | Shanghai Taihua Electronic Technology Limited | |||||||||||||

| CN | Su Zhou Precision Test Tech. Ltd. | |||||||||||||

| AS | Chief International Corp. | |||||||||||||

| AS | Chunghwa Precision Test Tech. International, Ltd. | |||||||||||||

| US | Chunghwa Precision Test Tech. USA Corporation | |||||||||||||

| US | Chunghwa Telecom Global, Inc. | |||||||||||||

| SG | Chunghwa Telecom Singapore Pte., Ltd. | |||||||||||||

| JP | Chunghwa Telecom Japan Co., Ltd. | |||||||||||||

| JP | CHPT Japan Co., Ltd. | |||||||||||||

| VN | Chunghwa Telecom Vietnam Co., Ltd. | |||||||||||||

| TH | Chunghwa Telecom (Thailand)Co., Ltd. | |||||||||||||

| VG | Prime Asia Investments Group Ltd. | |||||||||||||

Tax Disclosure

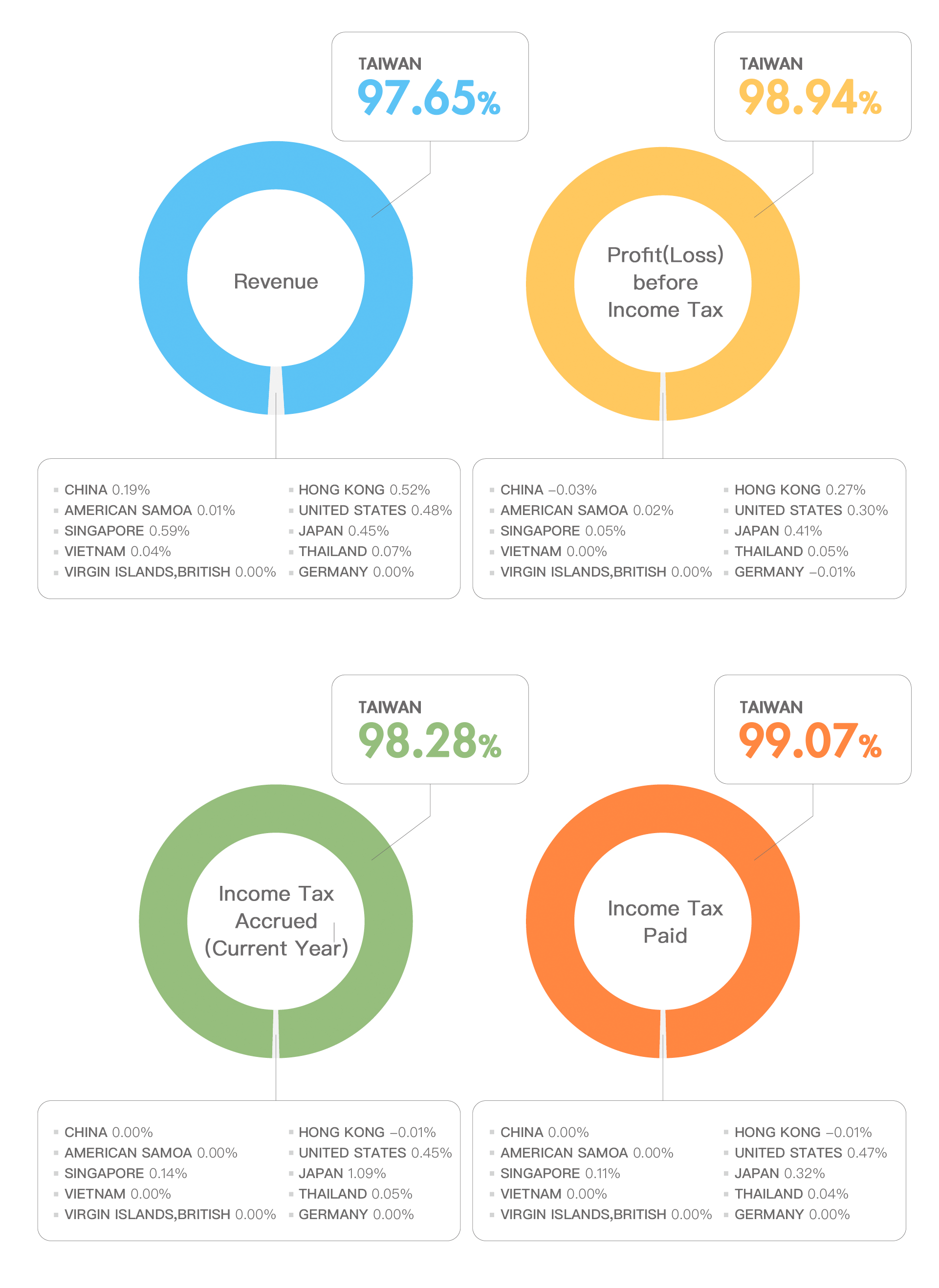

Over 96% of the revenue of Chunghwa Telecom comes from its operation in Taiwan while 99% of the paid income tax is to the Government of the Republic of China. The paid tax incurred from the operation of Chunghwa Telecom has a direct, positive influence on the support to the local government’s finance as well as the well-being of the people.

The income, pre-tax income, income tax expense, income tax paid, and number of employees of Chunghwa Telecom in the respective tax jurisdictions in 2024 are as follows (subject to the 2024 Country-by-Country Report):

Unit: NT$ Million, Person

| Tax Jurisdiction | Revenue | Profit (Loss) before tax | Income tax accrued (current year) | Income tax paid | Number of employees |

|---|---|---|---|---|---|

| TAIWAN | 252,271 | 46,967 | 9,049 | 8,860 | 30,001-33,000 |

| CHINA | 500 | -13 | 0 | 0 | 0-100 |

| HONG KONG | 1,356 | 129 | -1 | -1 | 0-100 |

| AMERICAN SAMOA | 18 | 7 | 0 | 0 | 0-100 |

| UNITED STATES | 1,231 | 142 | 41 | 42 | 0-100 |

| SINGAPORE | 1,515 | 25 | 13 | 10 | 0-100 |

| JAPAN | 1,156 | 193 | 101 | 28 | 0-100 |

| VIETNAM | 101 | 1 | 0 | 0 | 0-100 |

| THAILAND | 192 | 23 | 5 | 3 | 0-100 |

| VIRGIN ISLANDS, BRITISH | 0 | 0 | 0 | 0 | 0-100 |

| GERMANY | 0 | -3 | 0 | 0 | 0-100 |

The average effective tax rate for the consolidated income taxes of Chunghwa Telecom in 2023 and 2024 is 19.23%. The average effective rate and the actual tax paid are higher than that of industries worldwide.

- The average effective rate is higher than that of industries worldwide: Over 96% of Chunghwa Telecom's revenue streams come from Taiwan and that the statutory rate of Taiwan is 20% which is higher than that of industries worldwide.

- The average effective rate is lower than that of statutory rate of Taiwan: The cause of the difference lies in Article 42 of Income Tax Act, "the dividends or earnings received by a profit-seeking enterprise organized as a company, a cooperative, or other juristic person from its investment in another domestic profit-seeking enterprise shall not be included in its taxable income". It also benefits from the tax credits the Headquarters obtained for the expenditures specified in the Statute for Industrial Innovation in line with the government's policies for industrial innovation, industrial environment improvement, and industrial competitiveness elevation.

Unit: NT$ Million

| 2023 | 2024 | Average | |

|---|---|---|---|

| Earning Before Tax | 46,993 | 47,754 | |

| Income Tax Expense | 9,002 | 9,216 | |

| Effective Tax Rate | 19.16% | 19.30% | 19.23% |

| Income Tax Paid | 9,107 | 8,939 | |

| Cash Tax Rate | 19.38% | 18.72% | 19.05% |

Documents

-

Chunghwa Telecom Tax Policy and Management Procedures.pdf