Risk Management Committee

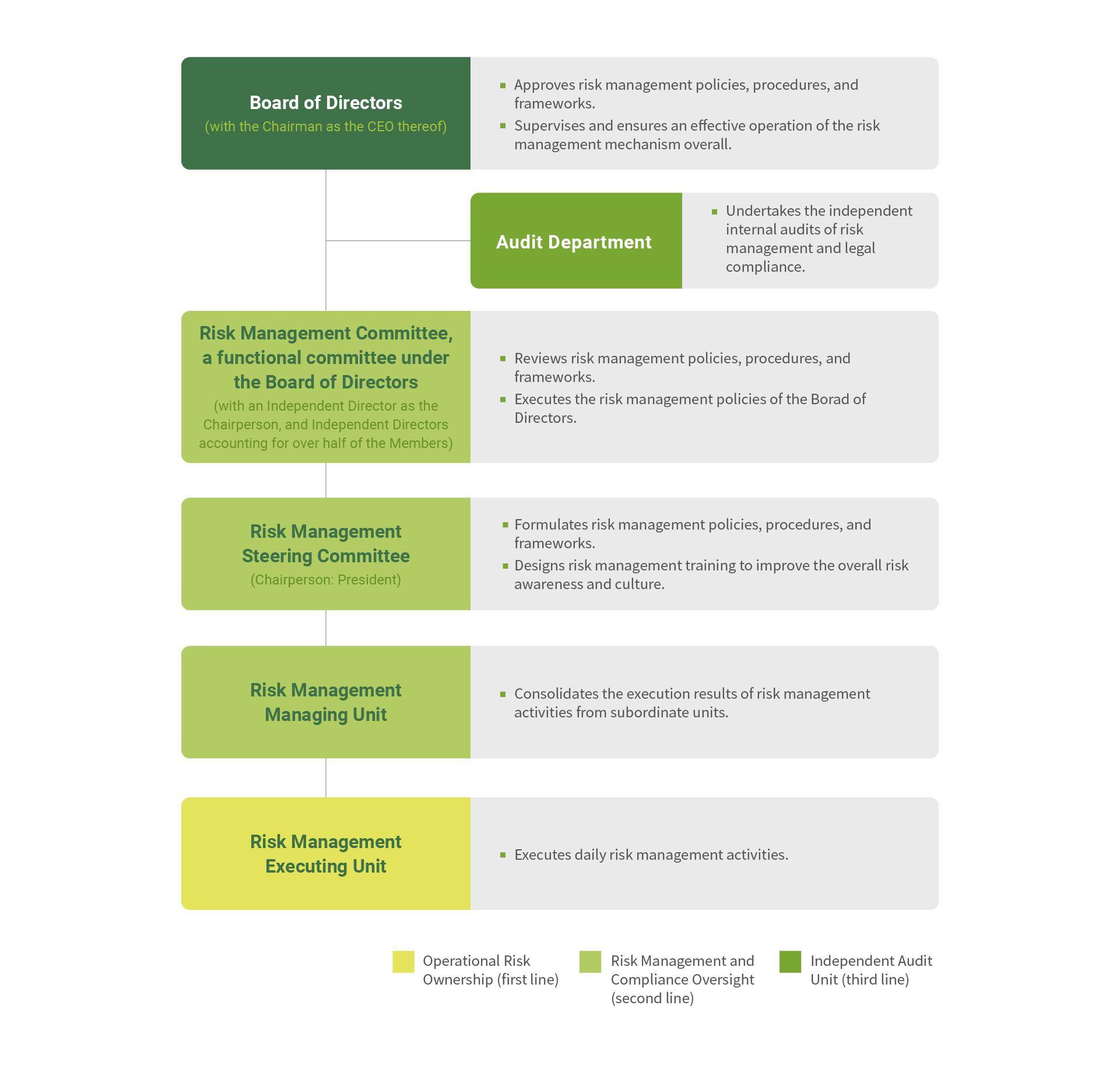

Chunghwa Telecom faces rapid operational, industrial, and technological changes, including challenges in market competition, technological evolutions, laws and regulations, as well as climate change. To ensure a robust development and sustainable development of the Company, the “Risk Management Committee” was officially established in 2016. Followed by its elevation to a functional committee under the Board of Directors in 2023 (the original management-level committee was renamed the “Risk Management Steering Committee”), the committee serves as the highest decision-making and supervisory body on risk management for the Board of Directors at the Company. (The Chairperson is an Independent Director, and >50% of the members are Independent Directors.)

The Risk Management Steering Committee is in charge of the review, monitoring, and formulation of corporate risk management policies and mechanisms as well as reports to the Risk Management Committee on a regular basis.In 2024, a total of 4 management-level and 4 Board of Directors' functional committees risk management meetings were held. And the concerns and guidance of the directors of the risk management committee were reported to the board of directors at the same time.

The Board of Directors stipulated the risk management policies, framework, and culture at CHT. The Risk Management Committee, a functional committee established under the Board of Directors, supervises and reviews risk management policies, procedures, and frameworks. The “Risk Management Steering Committee,” established at the management level, is in charge of promoting and implementing the overall risk management operations at the Company. The Audit Department reviews risk events, reports the risks that have already occurred to the Audit Committee, and reports the risks that are to occur or to be averted to the Risk Management Committee.

| Line of Defense | Description |

|---|---|

| First Line:

Risk Owner and Approval Process |

|

| Second Line: Risk Management Project Unit and Regulations |

|

| Third Line: Internal Audit |

|

To learn more about the risk management audit mechanism, please visit here.

Practice of Corporate Risk Culture

An Enterprise Risk Management(ERM)System is in place at CHT to manage various business risks. Meanwhile, risk management is tied with the performance appraisal of the executives to practice the culture of risk management.

| Aspect | Description |

|

Organization |

|

|

Policy |

|

|

Management System |

|

|

|

|

|

Appraisal |

|

|

|

|

|

Implementation Results in 2024 |

|